Holograph Terminal

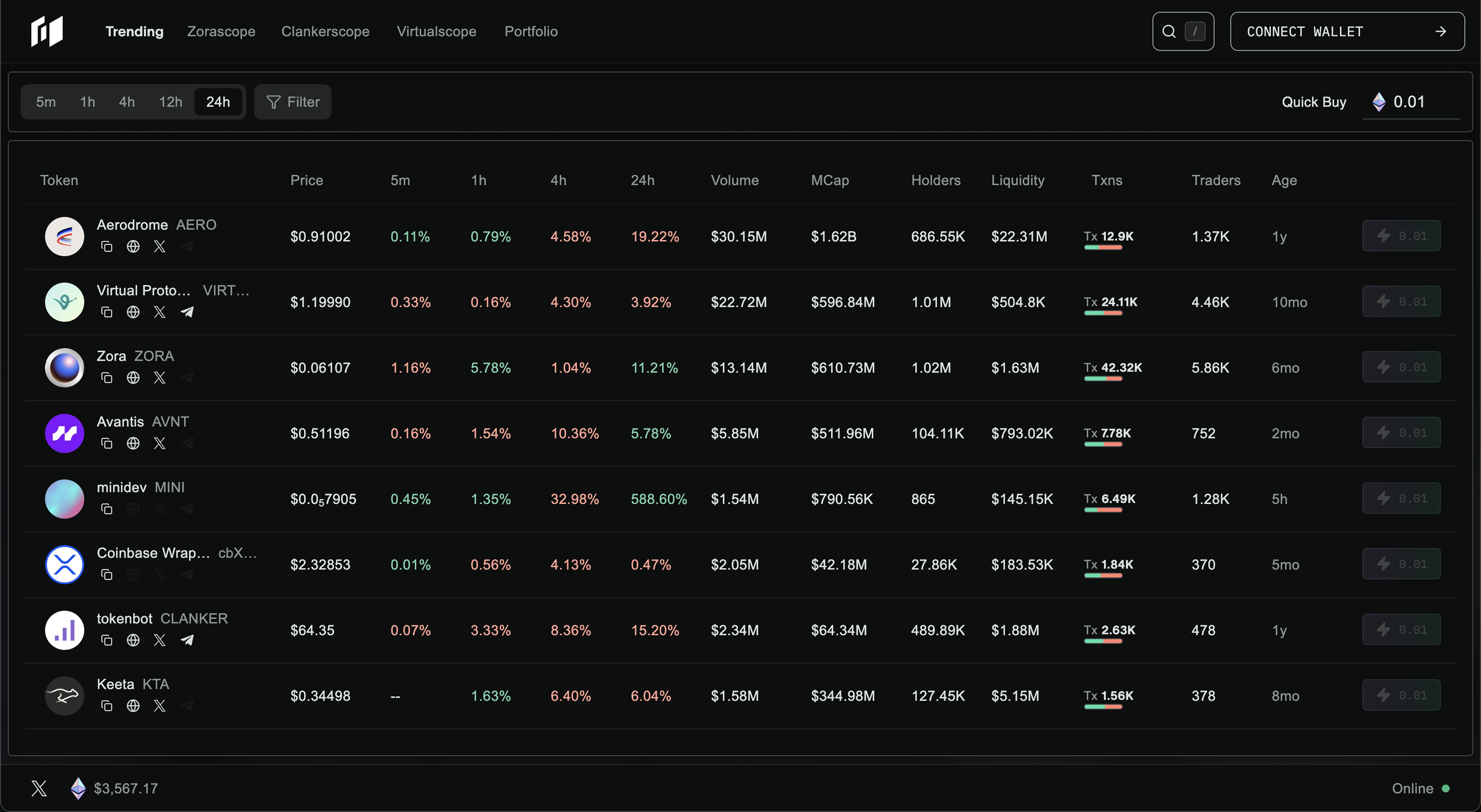

Trading and discovery interface for creator coins on Base

Holograph Terminal was a trading and discovery interface built for high-velocity creator coin markets on Base. I led product direction and iteration to give crypto-native traders faster execution, clearer market signals, and earlier access to new assets. The goal was speed, clarity, and control under real market pressure.

Context & Problem

Creator coins on Base were launching at an accelerating pace, often trading heavily within minutes of deployment. While activity was high, existing tools were optimized for casual users and struggled under the demands of active traders.

Discovery was fragmented across launchpads, execution paths were slow or opaque, and traders frequently missed early opportunities due to latency, slippage, or lack of actionable signal. The problem wasn't access to markets, but the absence of professional-grade tooling for discovery and execution in fast-moving environments.

Role & Constraints

I owned product for Holograph Terminal end to end, including:

- trader-facing execution flows

- asset discovery and market signal surfaces

- routing and quote presentation

- incentive and referral mechanics tied to trading behavior

Key constraints shaped every decision:

- highly volatile markets with users acting under extreme time pressure

- fragmented liquidity and uneven launch quality

- the need to surface dense information without slowing execution

The terminal had to support rapid decision-making without sacrificing execution confidence.

Discovery & Signals

Trader feedback and early usage patterns revealed consistent signals:

- speed to discovery mattered more than polish

- ecosystem-specific signal beat generic global lists

- latency and unclear routing directly impacted trust and repeat usage

I also observed that traders who discovered assets earlier and could act immediately were more likely to continue trading. Missed entries often led to disengagement. Discovery and execution emerged as a single, coupled problem.

However, early versions focused too heavily on breadth of asset coverage rather than quality of signal. This created noise that actually slowed traders down, the opposite of what they needed.

Strategy & Tradeoffs

I made deliberate choices to optimize for active traders:

Ecosystem-native discovery

Instead of a single global feed, I built ecosystem-specific discovery surfaces (Clankerscope for Clanker launches, Virtualscope for Virtuals Protocol assets) to surface early signals where activity was actually originating. These were custom dashboards that tracked new deployments and surfaced relevant metadata in real time.

Faster execution paths

I expanded base asset support (USDC, ETH, ZORA) to reduce friction between discovery and taking a position. Traders could move from spotting an asset to entering a trade without switching contexts or swapping tokens first.

Incentives tied to real volume

Referral rewards and fee sharing were tied directly to executed trades, with rewards tracked and settled onchain. This aligned growth with actual trading activity rather than vanity metrics.

These decisions favored density and speed over approachability, aligning the product with its intended audience.

Execution

I shipped a series of updates focused on tightening the loop between discovery and execution:

- multi-asset routing for faster position entry and exit

- real-time discovery dashboards for top Base launchpads

- onchain referral tracking with multi-tier fee rewards

- quality-of-life improvements to reduce cognitive noise during high-pressure trading

Iteration was driven by observed trader behavior and live feedback rather than abstract UX ideals.

Outcomes & Impact

The terminal reduced time from asset discovery to first trade and increased repeat trading behavior among active users during peak launch periods.

Fee-based rewards aligned trader growth with platform incentives, and usage concentrated among power users during high-volume periods.

More importantly, the product validated that professional traders valued speed and signal quality over feature breadth or retail polish.

Learnings

This work reinforced that in speculative markets, tooling is part of the edge.

Discovery without execution is noise, and execution without context is risk. Designing for active traders meant embracing density, opinionation, and incentives tied directly to real market activity.

I also learned that early assumptions about broad asset coverage were wrong. Traders didn't need access to everything; they needed earlier, clearer signals about what mattered. Curation and speed beat comprehensiveness.