Holograph Protocol

Cross-chain tokenization infrastructure

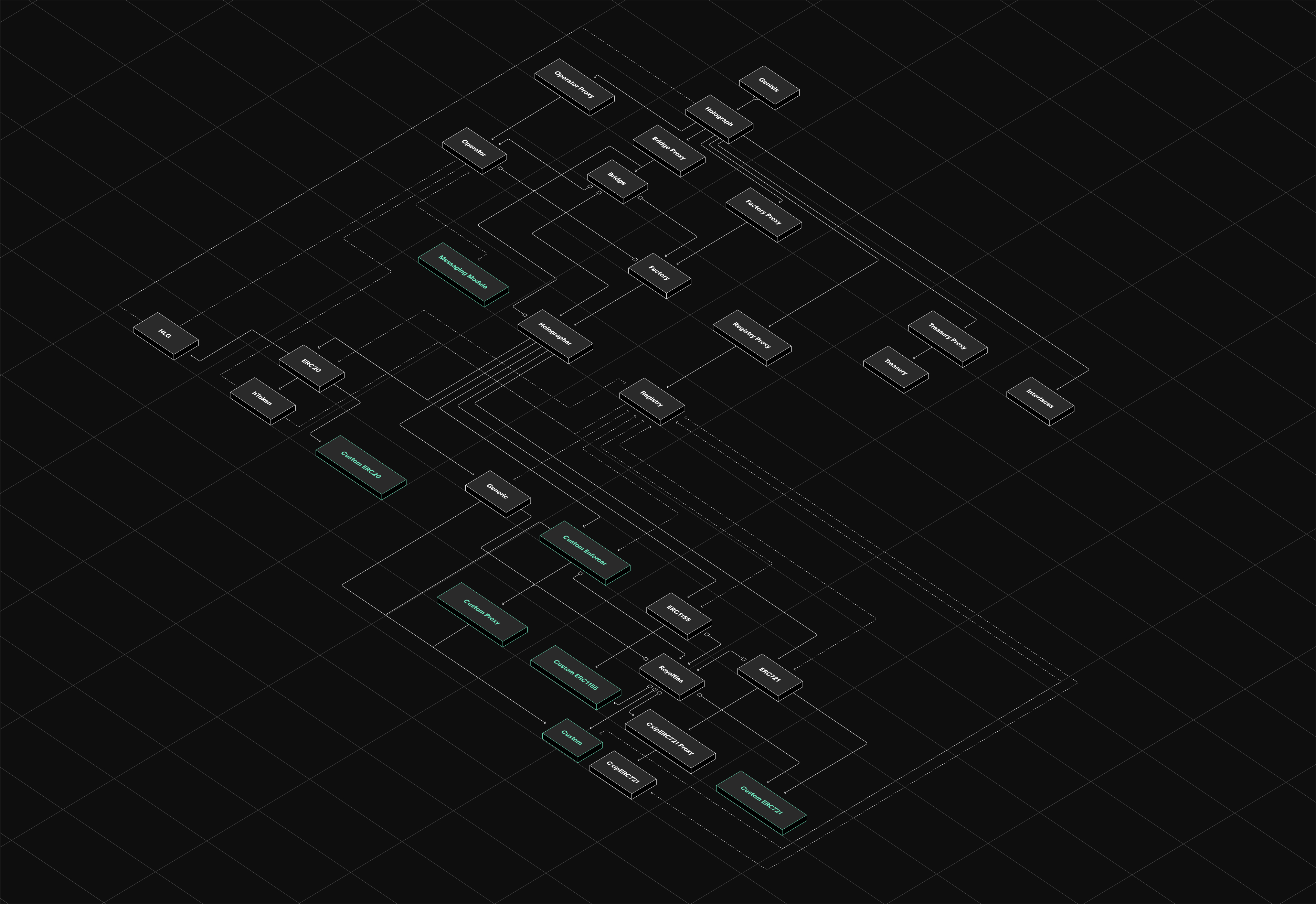

Holograph is a cross-chain tokenization protocol I co-founded to let assets get issued once and move across chains without fragmenting liquidity or identity. I led product from defining how the system worked to running it in production under real market conditions.

The protocol processed 15.9M transactions, deployed 676k+ contracts, and operated live across 9 networks.

Context & Problem

By the time I started Holograph, minting tokens wasn't the hard part anymore. I'd seen creators and brands deploy contracts across multiple chains, but each one was isolated. Users couldn't move assets between networks without bridges that added risk, broke composability, or required wrapping.

The real problem emerged after launch: users holding assets on one network often got stuck. Execution reliability varied by chain, and failures were difficult to reason about or recover from. More critically, I saw consistent patterns where initial demand at launch didn't translate to sustained activity. Secondary markets were thin, pricing was unclear, and liquidity evaporated quickly once the novelty wore off.

Making execution predictable at scale was necessary but not sufficient. I needed to understand what made assets succeed beyond issuance.

Role & Constraints

I served as Co-Founder and Head of Product, owning product strategy and roadmap across the protocol, APIs, and partner-facing tooling.

My responsibilities included:

- defining token lifecycle primitives

- shaping execution guarantees and failure handling

- prioritizing work across engineering, design, and BD

- aligning technical decisions with long-term platform trust

The constraints were real and non-negotiable:

- heterogeneous finality, reorg depth, and RPC failure modes across networks

- irreversible onchain actions

- limited tolerance for downtime or silent failure

- increasing transaction volume under volatile market conditions

Every decision required balancing speed, safety, and durability.

Discovery & Signals

Early usage and partner feedback revealed consistent patterns:

- execution failures were difficult to interpret

- recovery paths were unclear or manual

- behavior varied across networks in ways that compounded quickly

More significantly, I observed that strong issuance metrics didn't correlate with durable markets. Free or near-free mints distorted pricing. Non-fungible assets were hard to value post-launch. Without ongoing utility or clear market structure, most assets showed high initial participation but minimal sustained activity.

This shifted how I evaluated success. Distribution and launch metrics were misleading. What mattered was repeat behavior, secondary activity persistence, liquidity depth under stress, and whether holders had actual reasons to keep or trade the asset.

Predictability and recovery weren't just execution problems. They were trust problems that determined whether assets could succeed long-term.

Strategy & Tradeoffs

I made several tradeoffs to prioritize system durability over launch velocity:

Optimize for predictability over flexibility

Rather than supporting every issuance or execution pattern, I constrained the system around a small set of guarantees. This reduced edge cases and made failures easier to reason about. I shipped fewer features but the ones I shipped were more reliable.

Treat failure recovery as a first-class product surface

Cross-chain execution fails in non-obvious ways. I invested in explicit execution states and recovery paths instead of assuming happy paths. This became essential once transaction volume increased and ambiguous failures eroded partner trust.

Deprioritize theoretical interoperability in favor of demonstrated utility

Early assumptions about portability driving adoption didn't hold. Liquidity, discovery, and predictable execution mattered more. I adjusted priorities to reflect what actually created durable markets.

Filter for quality over volume at issuance

Supporting more launches inflated short-term activity but diluted attention and liquidity. I became more selective about what I helped bring to market.

Each decision limited short-term metrics but strengthened the foundation for assets that could succeed post-launch.

Execution

These choices shaped how the protocol was built and operated in production.

I defined clear execution states, standardized lifecycle primitives, and worked closely with engineering to ensure behavior was consistent across networks. As the system scaled, I continuously refined recovery paths and operational tooling to reduce ambiguity during failures.

This allowed the protocol to operate continuously under real market conditions with improving reliability over time.

Outcomes & Impact

Over time, the protocol reached sustained production scale.

The protocol operated live across 9 networks under real market conditions.

Execution success rates improved materially, support burden dropped, and partners gained confidence integrating Holograph into their products. The system became predictable enough for teams to build on without constantly addressing edge cases.

Learnings

This work fundamentally changed how I evaluate tokenization infrastructure.

Strong issuance metrics can mask weak market foundations. Distribution answers whether people showed up once, not whether they came back. I would have invested earlier in understanding what creates durable markets, not just efficient launches.

I also underestimated how quickly edge cases compound under real usage versus controlled testing. Theoretical portability matters far less than demonstrated utility and clear market structure.

Tokenization at scale is an operating problem, not a launch problem. Durable systems require predictability, recovery mechanisms, and designs that help assets succeed after they exist, not just efficient ways to create them.